Features

Eligibility

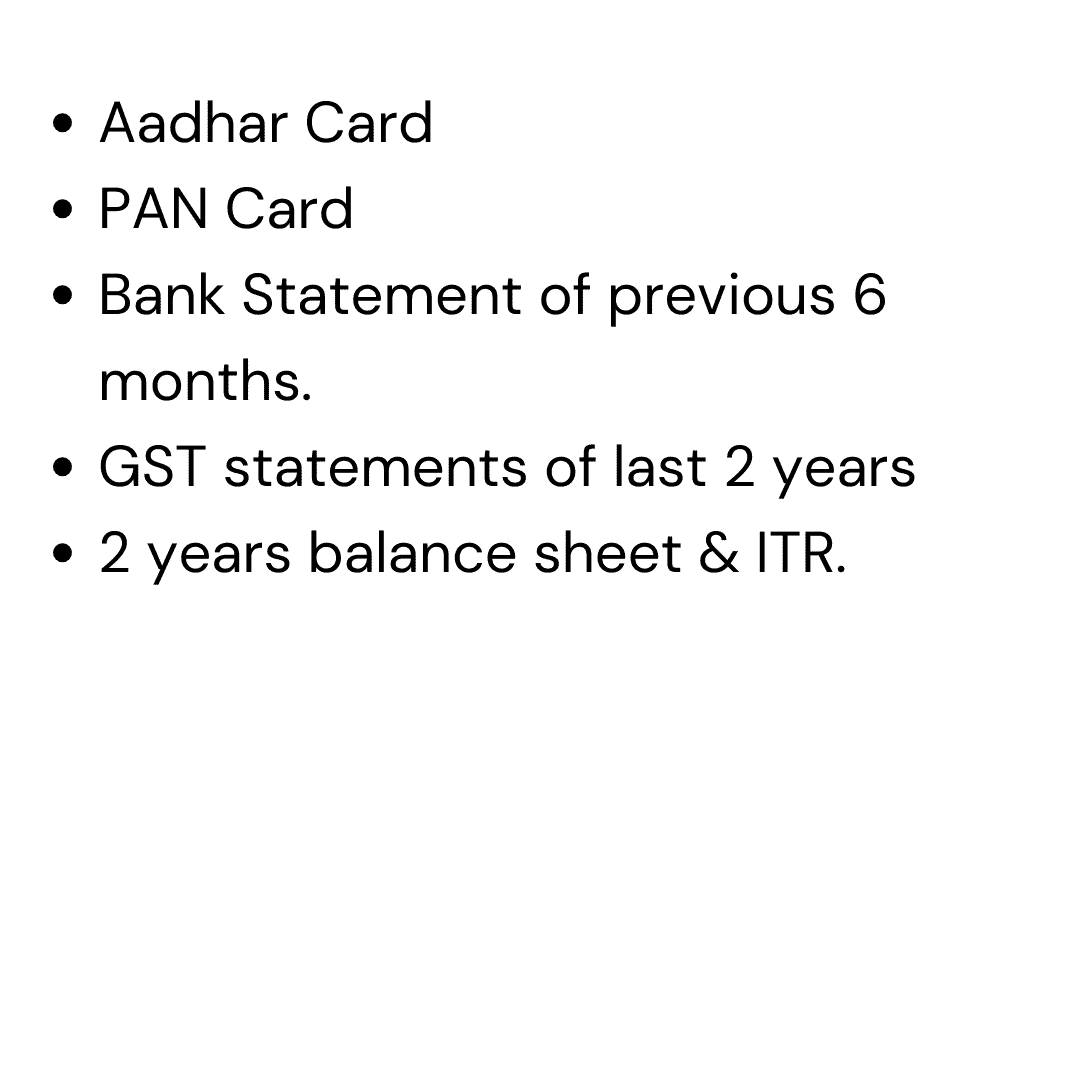

Documents Required

How fast can the business loan be approved?

Loan approvals can happen within 24–72 hours, provided all documents are in order. Disbursement typically follows soon after approval.

What are the Benefits of Taking a Business Loan from Us in Bangalore?

Choosing us for your business loan in Bangalore offers several key advantages:

- Loans from top private banks and NBFCs with competitive interest rates

- Fast approvals and quick disbursal to help you meet urgent business needs

- Minimal documentation required with doorstep collection service

- Unsecured loan options available—no collateral required for eligible applicants

- Tailor-made loan offers based on your business profile and turnover

- Transparent process with no hidden charges or fees

- Expert consultation and support throughout the application process

- Balance transfer and top-up facilities available for existing loans

Call or WhatsApp us at +91 90363 57534 to apply for your business loan in Bangalore today.

Types of Business Loans We Offer in Bangalore

- Working Capital Loans

- Expansion Loans

- Equipment Financing

- Purchase/Refinance

- Balance Transfer Loan

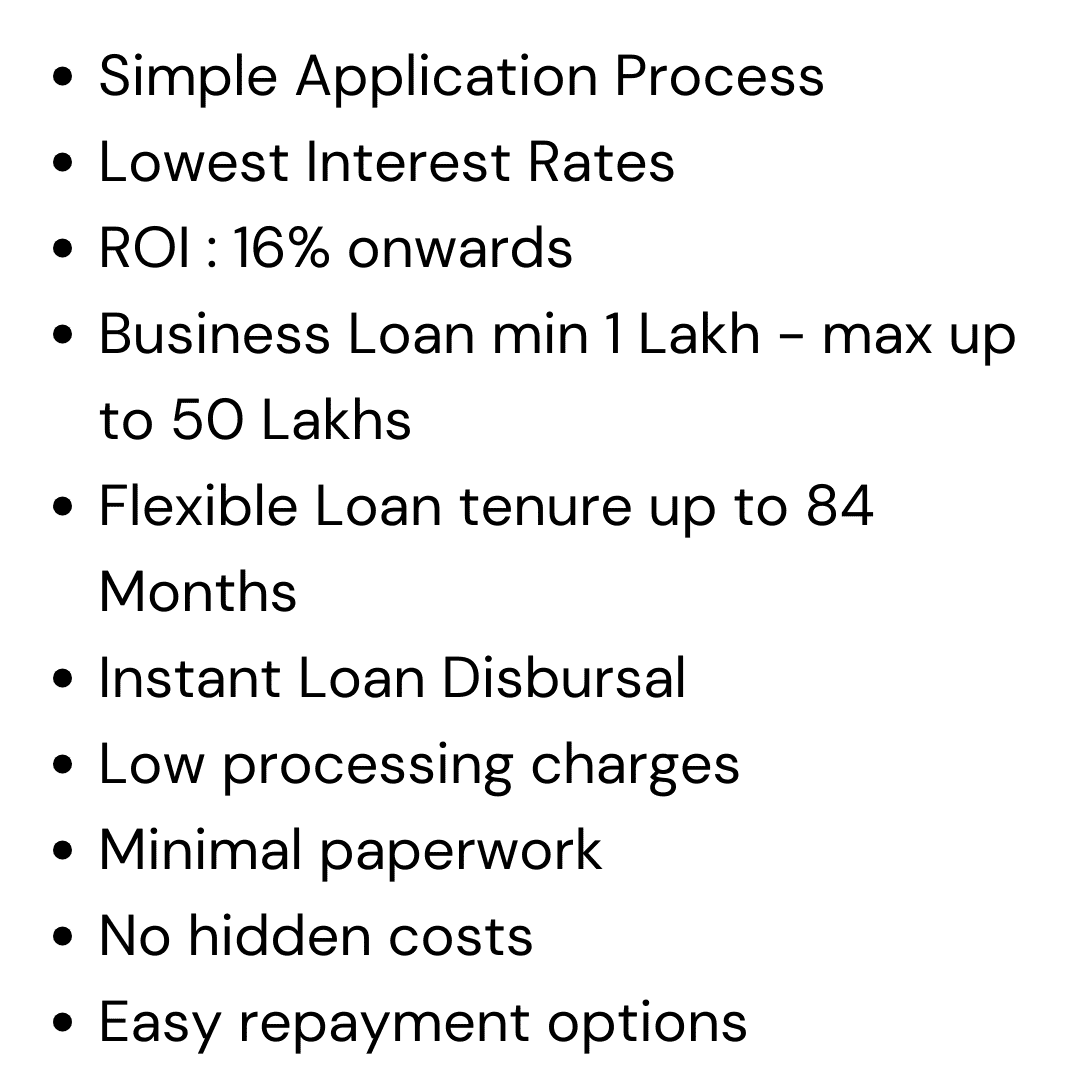

What is the interest rate for business loans in Bangalore?

Business loan interest rates in Bangalore typically start from 16.00% per annum, varying based on credit profile, turnover, and business vintage.

What is the minimum and maximum business loan amount in Bangalore?

You can avail loans starting from ₹1 Lakh up to ₹50 Lakh or more, depending on eligibility, business performance, and lender policies.

How long is the repayment tenure for business loans?

Business loan tenures range from 12 months to 84 months, with flexible EMI options based on your business cash flow and preferences.

How to Apply for a Business Loan in Bangalore

Getting a business loan with us is quick and hassle-free:

- Call/WhatsApp us at +91 90363 57534

- Submit your basic business documents

- We process and get your loan approved within a 1-2 working days.

Do you help with the paperwork for business loans?

Yes, we provide complete end-to-end assistance with documentation and application to ensure faster loan processing and minimal effort from your side.

Who is eligible to apply for a business loan in Bangalore?

- Indian Resident

- Age: 22 – 55 Years

- Minimum 2 Years of Business Vintage

- Stable Monthly Turnover

- Clean Credit Record