Car Loan

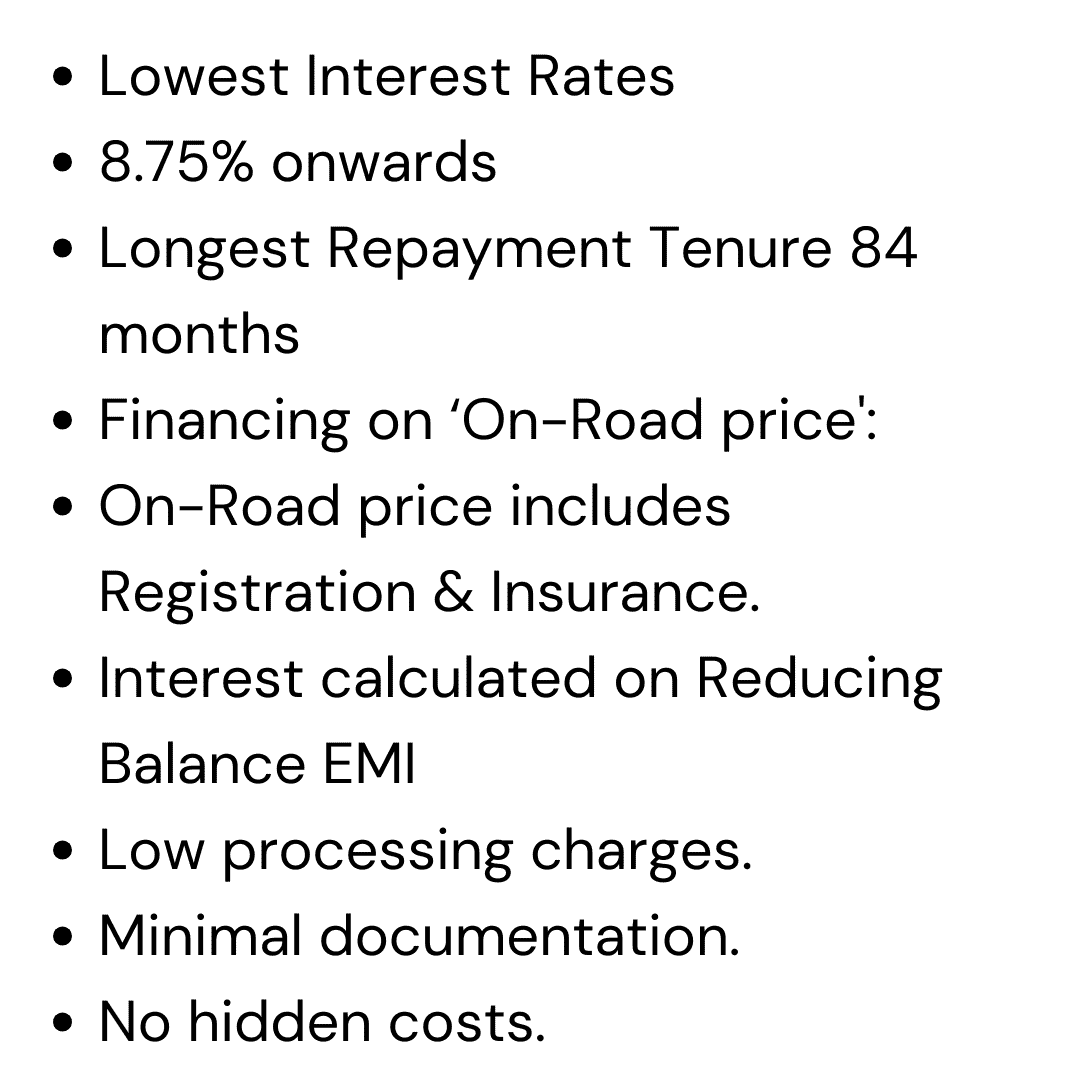

Features

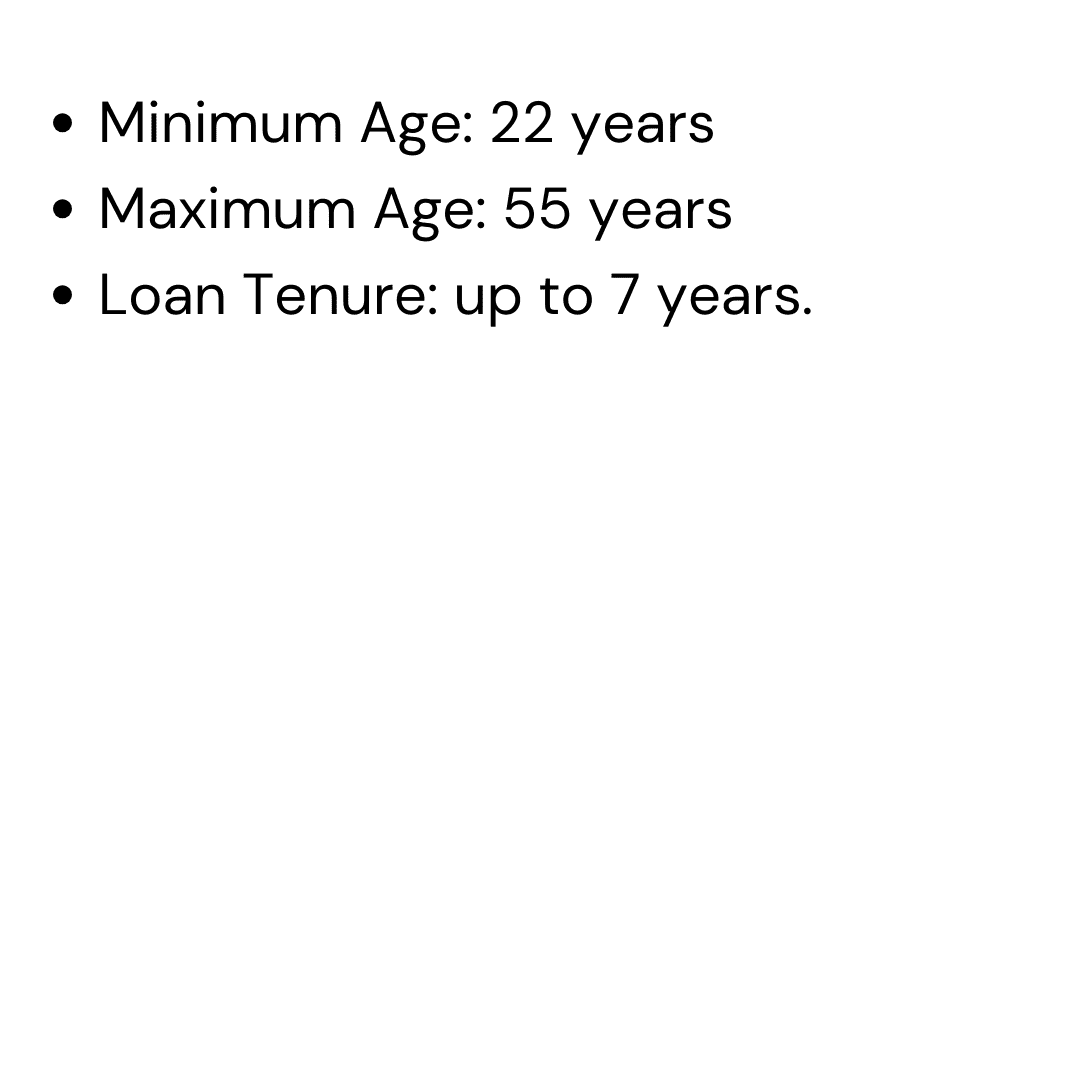

Eligibility

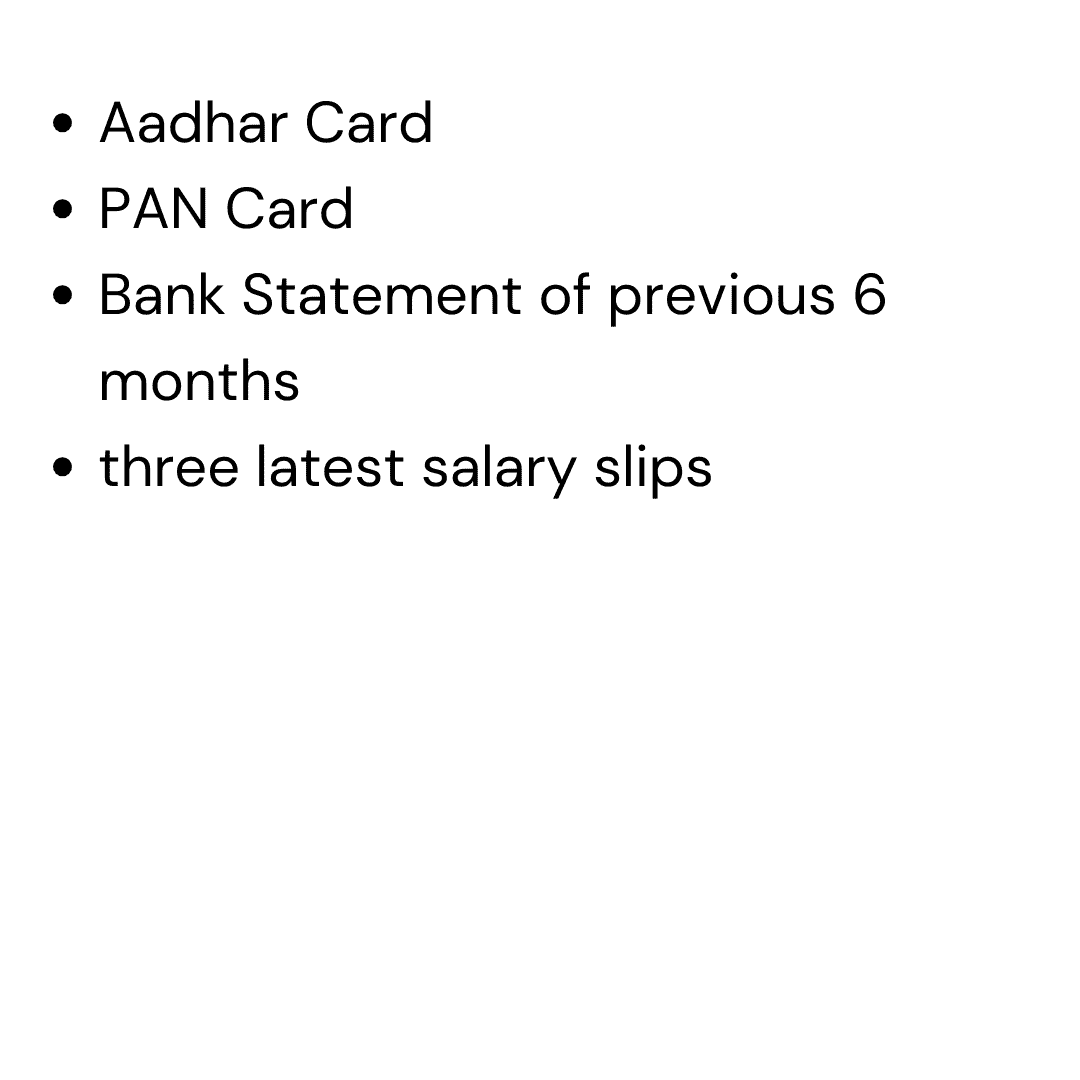

Documents Required

How to Apply for a Car Loan in Bangalore

- WhatsApp / Call us: +91 90363 57534

- Submit Your Documents

- We Get Your Loan Approved within 24-48 hours

Types of Car Loans Available

- New Car Loan

- Used Car Loan

- Top-Up Loan

- Balance Transfer Loan

What types of cars are eligible for car loans in Bangalore?

Car loan interest rates in Bangalore start from as low as 8.75% per annum, depending on your credit score, income, and the lender’s policy. We help you compare the best rates from leading banks and NBFCs.

Can I finance a used car in Bangalore?

Yes, we provide car loans for both new and pre-owned vehicles in Bangalore. Loan terms, interest rates, and eligibility may vary based on the age and condition of the car.

What is the loan tenure available?

You can choose a flexible car loan tenure from 12 months up to 84 months (7 years), depending on your repayment capacity and the car model.

Are car loans available for self-employed individuals in Bangalore?

Absolutely! Self-employed applicants can also apply for car loans with valid income proof and business documents. We work with multiple lenders to ensure quick approval.

How soon is the loan amount disbursed?

Car loan disbursement is usually completed within 24 to 48 hours after document verification and loan approval, ensuring a hassle-free experience.

Do I need to visit the office to apply for a car loan in Bangalore?

No need! You can apply online or via WhatsApp. We offer 100% digital application, document pickup, and doorstep service.

📞 Call/WhatsApp: +91 90363 57534

📞 Call/WhatsApp: +91 90363 57534

Can I apply for a car loan with minimal documents in Bangalore?

Yes, we accept minimal documentation for faster processing. Basic documents like Aadhaar, PAN, bank statements, and income proof are sufficient.

What types of cars are eligible for car loans in Bangalore?

Car loans are available for a wide range of new and used vehicles, including hatchbacks, sedans, SUVs, and luxury cars, provided they meet the age and condition criteria.

Do you provide car loan for electric vehicles (EVs) in Bangalore?

Yes, we facilitate car loans for electric vehicles (EVs) at attractive interest rates with exclusive schemes supported by banks and NBFCs for promoting green mobility.

What documents are required for a car loan in Bangalore?

Basic documents include:

- Aadhaar & PAN Card

- Last 6 months bank statements

- Salary slips / ITR (for self-employed)

- Car quotation/invoice

We assist in document collection as well.

Do you offer loan services for commercial vehicles in Bangalore?

Yes, we also offer loans for commercial and utility vehicles used for business purposes. These loans come with custom eligibility and tenure options.

Can I get a car loan if I’m a first-time borrower in Bangalore?

Yes, first-time borrowers with stable income and basic KYC documents can easily qualify. We guide you through the best lender options suited for new applicants.